Swing Line Loan

A revolving loan is used where the funding requirements of the company.

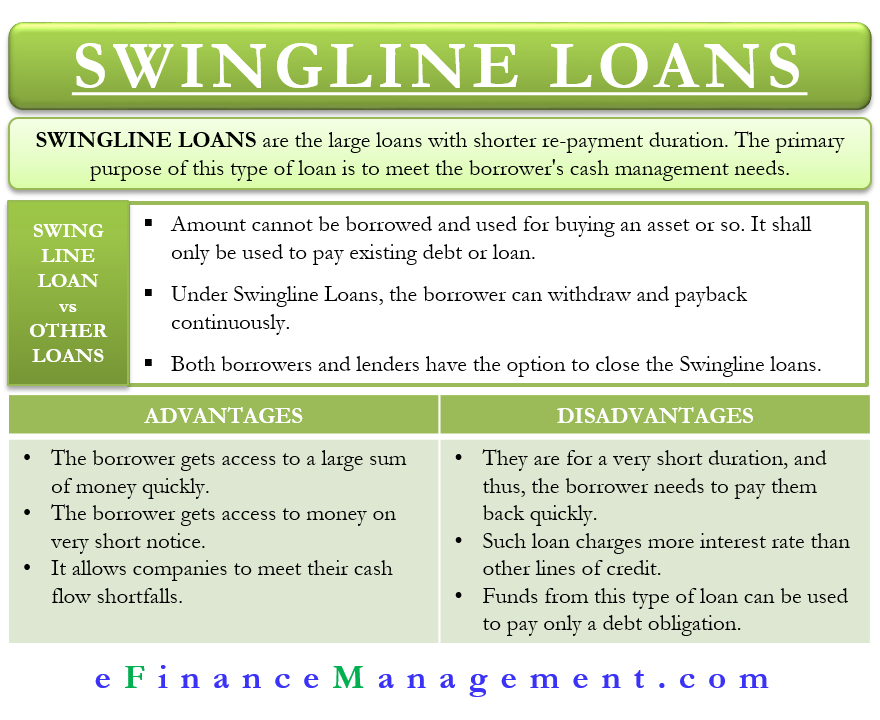

Swing line loan. The swing line lender could do the full advance up to a pre agreed limit typically 10 20 of the total facility for acco the swing line limit was 30 million r calton 2013. Swing line lenders means a initially bank of america and b any of the other lenders designated by the borrowers from time to time in a writing delivered to the administrative agent provided that not more than three lenders shall be swing line lenders at any time. Necessity is the mother of innovation during the credit crisis. A swing line loan is a short term loan made directly by one lender typically the administrative agent to the borrower on shorter notice than is required for a syndicated loan from all of the lenders.

The purpose is to support the borrower s cash management needs. A swingline loan can take the form of revolving credit which is a line of credit that the borrower can draw on and payback repeatedly though the loan normally has an upward limit as long as. Swing line loan means as the context may require at any time the aggregate amount of swing line advances outstanding to any borrower or to all borrowers. It is a large amount of loan but for a very short duration average of 15 days and on shorter notice.

The interest rate on such loans is higher than the usual loan. In addition to standard loan arrangements such as revolving credit lines and term loans syndicated loans frequently include other credit products such as letters of credit and swing line loans. Sample 1 sample 2.

:max_bytes(150000):strip_icc()/sofi_inv_new-e240ebec28eb47379e7a0734543fb463.png)

:max_bytes(150000):strip_icc()/earnin-inv-e01c21537df64c97a457ffd18ece4939.png)